santa clara county property tax collector

Services - Department of Tax and. Santa Clara County collects on average 067 of a propertys.

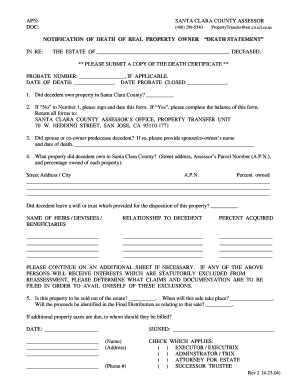

Santa Clara County Death Statement Fill Online Printable Fillable Blank Pdffiller

Pay your General Justice Public Assitance Legal and Medical collections accounts.

. Look up and pay your property taxes online. Parcel Maps and Search Property Records. County of Santa Clara COVID-19 Vaccine Information for the Public.

MondayFriday 800 am 500 pm. Based On Circumstances You May Already Qualify For Tax Relief. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information. Ad See If You Qualify For IRS Fresh Start Program. Pay Property Taxes.

Enter Property Address this is not your billing address. Property Tax Rates for Santa Clara County. Wednesday Aug 17 2022 924 AM PST.

You will need your Assessment Number Assessors. Find Information On Any Santa Clara County Property. Send us a question or make a comment.

The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. The Assessors Office allows residents to view free of charge basic information about properties in Santa Clara County such as assessed value. Free Case Review Begin Online.

An escape assessment is a correction to a personal propertys assessed value that the Assessors Office of the County of Santa Clara did not add to any prior years Annual. Wednesday Aug 17 2022 1241 AM PST. Pay Property Taxes Franchise Fees and Transient Occupancy Taxes.

Last Payment accepted at 445 pm Phone Hours. Monday Aug 15 2022 534 PM PST. MondayFriday 900 am400 pm.

The Controller-Treasurers Property Tax. Ad Find Santa Clara County Online Property Taxes Info From 2022. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

Enter Property Parcel Number APN. Wednesday Aug 17 2022 1028 AM PST. You will need your Assessors Parcel Number APN or property address.

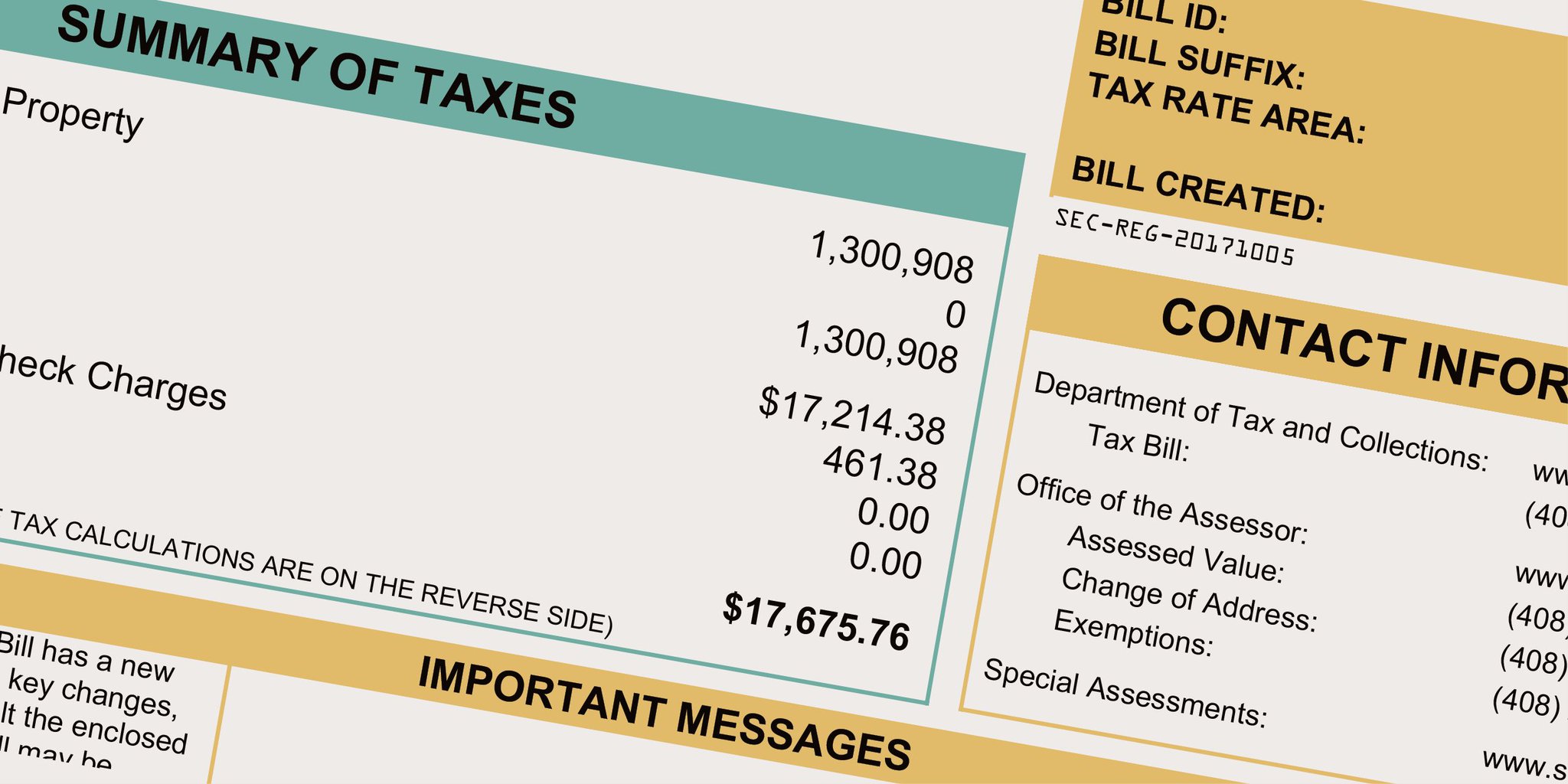

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Scam Alert County Of Santa Clara California Facebook

Santa Clara County Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Property Taxes Department Of Tax And Collections County Of Santa Clara

Longtime Santa Clara County Assessor Looks To Be The Winner Again San Jose Spotlight

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Property Taxes Department Of Tax And Collections County Of Santa Clara

County Of San Mateo Government Quick Tip Tuesday Some Santa Clara County Taxpayers Reported Receiving Bogus Letters Like The One Pictured In This Post From A Non Existent Tax Lien Office